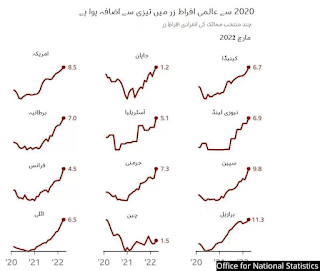

Last year, prices in every business began to rise at a pace not seen in decades before. Among the major economies, the one country most affected is the United States.

According to the Organization for Economic Co-operation and Development (OECD), prices in the United States rose 4.7 percent year-on-year last year, more than any other country in the Group of Seven (G7) developed economies. There is a rapid increase. In the UK, for example, inflation was only 2.5%.

Last month, inflation in the United States reached 8.6 percent, one of the highest in the world.

Factors that pushed up inflation last year, such as supply disruptions from cod and rising food prices after crops were damaged by severe storms and droughts, were not unique to the United States.

The reason for America's poor performance? The answer can be given in just two words. High demand

These were the 5 trillion approved by the US government to protect American families and businesses from the effects of the slowdown in economic activity caused by the epidemic.

Government Expenditure

Assistance through family financing, including the issuance of direct checks to households, helped people continue shopping.

There was an increase in orders for goods such as furniture, cars and electronics, as buyers used the money for other purposes, for example they could spend it on restaurants and trips.

And because of the supply-side constraints caused by the unusually high demand, traders have pushed up prices because of this shortage of supply.

A recent study by the Federal Reserve Bank of San Francisco concludes that epidemic relief packages are likely to account for 3% of inflation by the end of 2021, a factor that Suffice it to say that US inflation was much higher than the rest of the world.

Oscar Jorda is a senior policy advisor at the Federal Reserve Bank of San Francisco and one of the people working on this research. He warned that it would be inappropriate to draw conclusions from the increase, but said that the increase paints a picture of the situation on the ground as a whole.

He said in an interview in May that "this program (aid package) ... Consumers' pockets were flooded with liquidity at a time when the industry may not be ready to supply in response to rising demand. " I would say inflation.

Federal Bank's slow response

Even before the aid package was approved, fears of rising inflation were warned, especially by Harvard economist Larry Summers, a longtime Democratic policy adviser who also advises some Republicans. have been.

But other experts, including the Federal Reserve, the head of the US Federal Reserve, have argued that the rise in prices is "temporary" and will end soon, as the supply chain problems related to Quid will end.

Ricardo Race, a professor and economist at the London School of Economics, says the Federal Reserve Bank - which introduced policies to accelerate economic activity at the onset of epidemics - has been slow to find a solution to rising prices, even in the United States. Inflation began to exceed expectations.

"This is the (higher-than-expected increase) that turned from a temporary increase to a permanent increase and again the Fed (Federal Reserve Bank) was slow to respond."

As checks boosted purchasing power by boosting economic activity for American households, rising prices, despite wage cuts, were not widely felt as a cost of living last year.

But as savings are spent, the climate changes, which is creating a serious political problem for US President Joe Biden. However, Republicans accuse President Joe Biden of raising current prices.

|

| Biden's popularity has plummeted as inflation concerns have intensified. |

Joe Biden, in response to Republican demands, has thrown all the rubble of inflation into the Ukraine conflict, which has affected oil supplies and exports of commodities such as wheat, has pushed up prices and is now suffering. The world is feeling.

In the euro area, prices rose at an annual rate of 8.1% in May, with Russia's closest oil-gas-dependent countries, such as Estonia, rising by 20.1%.

The OECD said the UK was also a major dependent on food and energy imports, with inflation rising to 7.8 per cent in April, lagging behind the US in developed economies. There was a maximum bill limit.

Consumer price data from the British government, which excludes a measure of housing costs included in the OECD figures, showed an even faster increase of 9%.

Even in Japan, which has struggled to keep its inflation rate below zero, prices rose 2.5 percent in April.

The OECD expects inflation to average 5.5 percent in developed economies and 8.5 percent for all 38 member countries before it returns to 2023 this year.

Professor Race said he hoped the steps taken by the Federal Reserve, the Bank of England and others to address the issue, including raising interest rates, would improve the situation.

By making borrowing more expensive, such measures help control the demand of households and businesses, and reduce the pressure of rising prices.

"I hope - but it's a little too uncertain - that this could happen without causing a recession," he said, adding that a return to the normal 2% target was unlikely. "That's the big question."

Rising inflation in the short term can only exacerbate economic uncertainty, especially in small countries, which are prone to sudden fluctuations in money supply and exchange rate fluctuations, and Most are active and dynamic with a rate increase.

Even in big economies, politicians are looking for ways to meet the cost of living for families affected by low prices.

The UK government has recently announced a ارب 15 billion aid package through windfall tax on oil and gas firms to help with rising energy bills.

Some European countries, such as Spain and Portugal, have set gas price limits. This is a reaction that economists generally advise against, as limiting prices tends to increase demand.

In the United States, Biden has extracted a lot of oil from national reserves in an effort to reduce petrol prices.

But as tensions in Ukraine complicate supply issues, analysts say the power of politicians and central banks to deal with them is limited.

"In the long run, they can do a lot in terms of investing in different energy transfer policies and things like that," says Jorda. But not much can be done in the short term. "

0 Comments